Defrauding Tricks

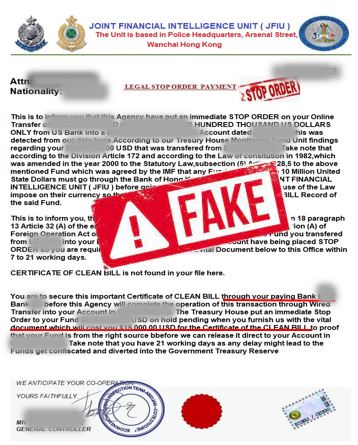

- Recently, the Joint Financial Intelligence Unit (“JFIU”) received public enquiry over a fraudulent “stop order” purportedly issued by JFIU. The order requested the recipient to pay a sum of fee in order to obtain a certificate to prove the legitimacy of the remittance that he/she has made, so that the transaction could proceed.

Our Advice

- The JFIU has never issued such order, or any similar order directing recipient to pay for a fee to effect any financial transaction.

- Genuine law enforcement officers will not request you to settle any fees or ask for your online banking account number or password for investigation of cases;

- Even if the scammers are able to provide your personal information or remittance details and send you their law enforcement credentials, it does not necessarily mean that they are genuine law enforcement officers. Scammers can obtain the personal information of the public through open access, security loopholes and even illegal sources;

- Do not disclose your personal information to strangers, including your HKID number, address, online banking accounts and PIN codes;

- Verify the identity of the contact by calling the relevant organisation directly – find them through an independent source such as a phone book or online search. Do not use the contact details provided in the message sent to you.

- Do not click on unknown hyperlinks or input any information;

- Remind your relatives and friends to stay vigilant against deception;

- If in doubt, please call the “Anti-Scam Helpline 18222” for advice and consider report the matter to the Police.

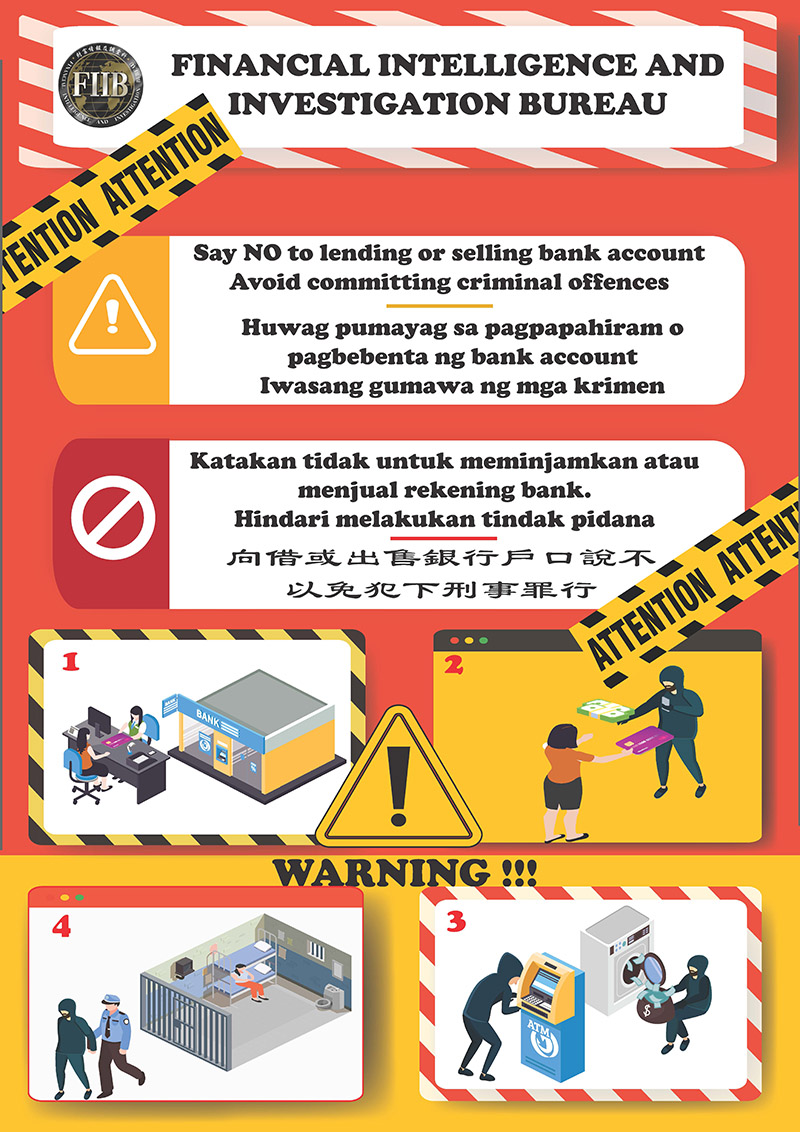

Financial Intelligence and Investigation Bureau x “Project AccFencers”

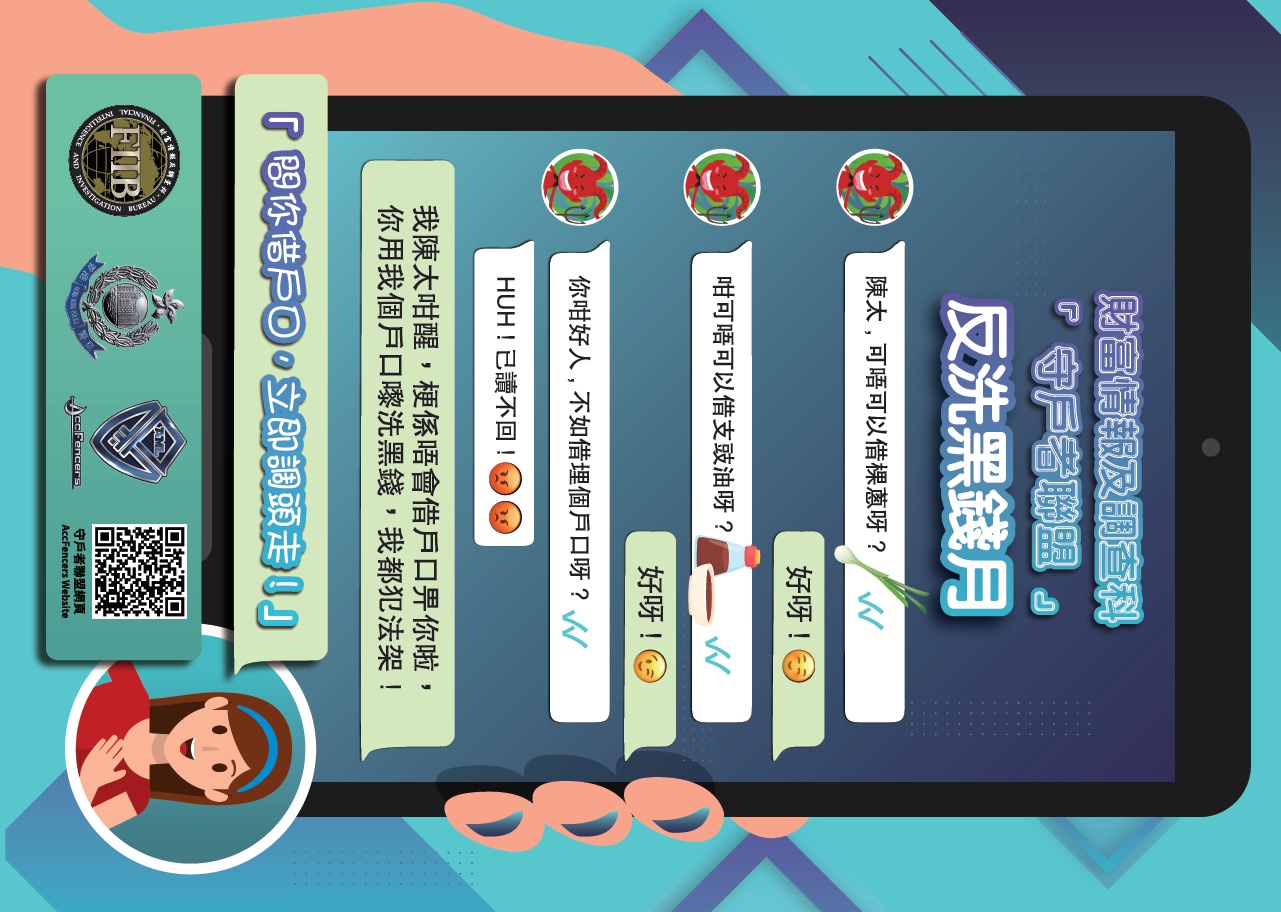

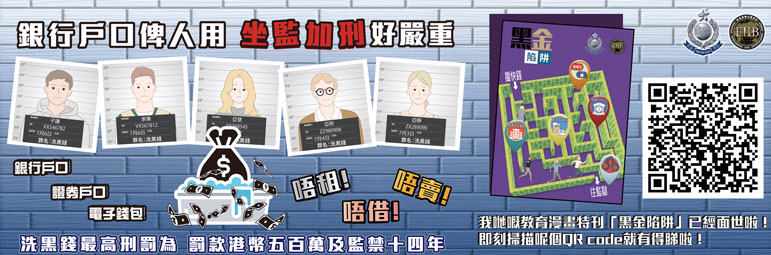

To enhance public awareness of anti-money laundering and counter-financing of terrorism, the Financial Intelligence and Investigation Bureau has rolled out an anti-money laundering programme, namely the "Project AccFencers”, since November 2021.

The title "Acc” stands for "Account” and "Fencers” implies attack and defence in a fencing game. The project rallies the efforts of all sectors and the public to combat money laundering and safeguard Hong Kong’s status as one of the safest and healthiest international financial centres in the world.

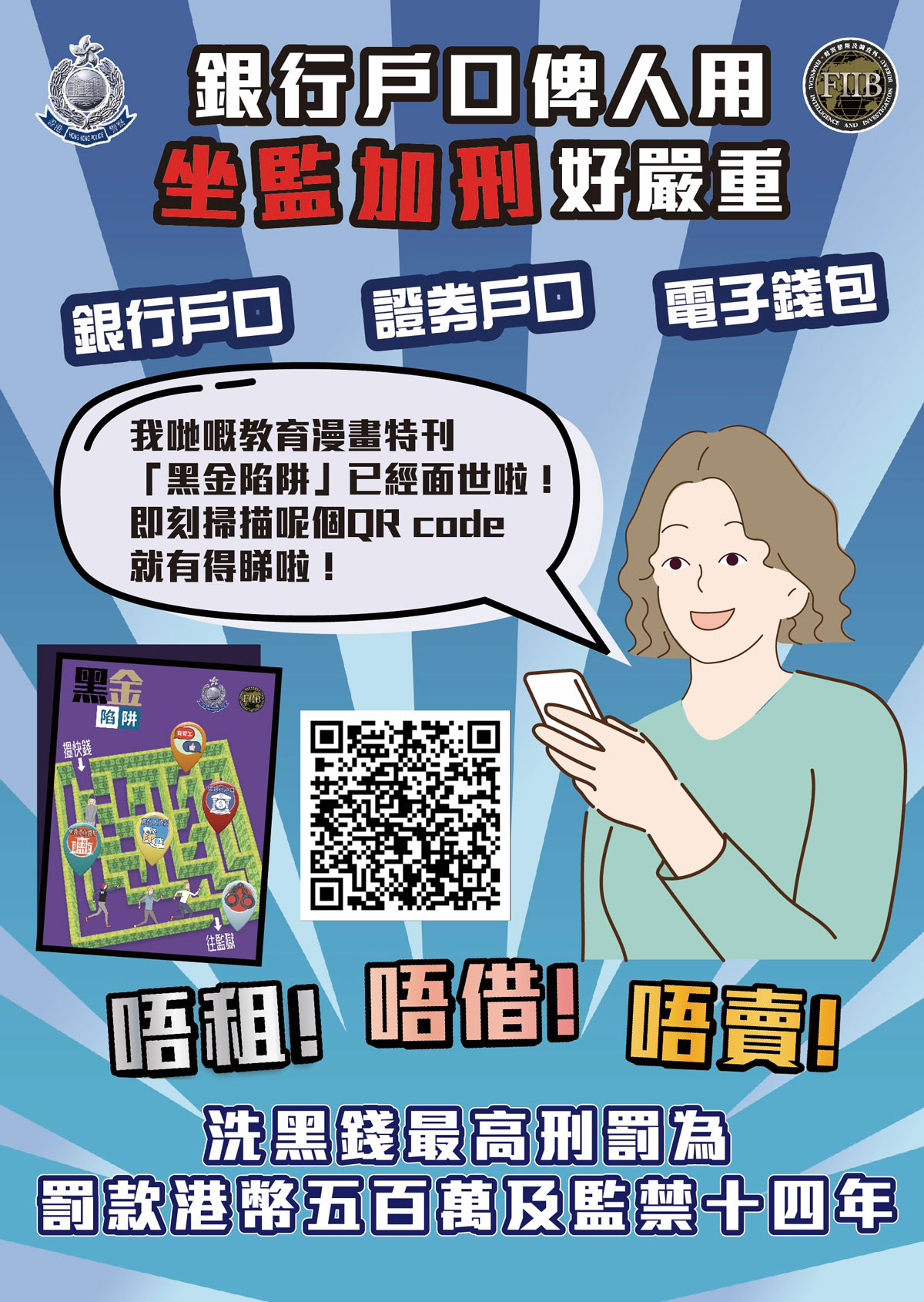

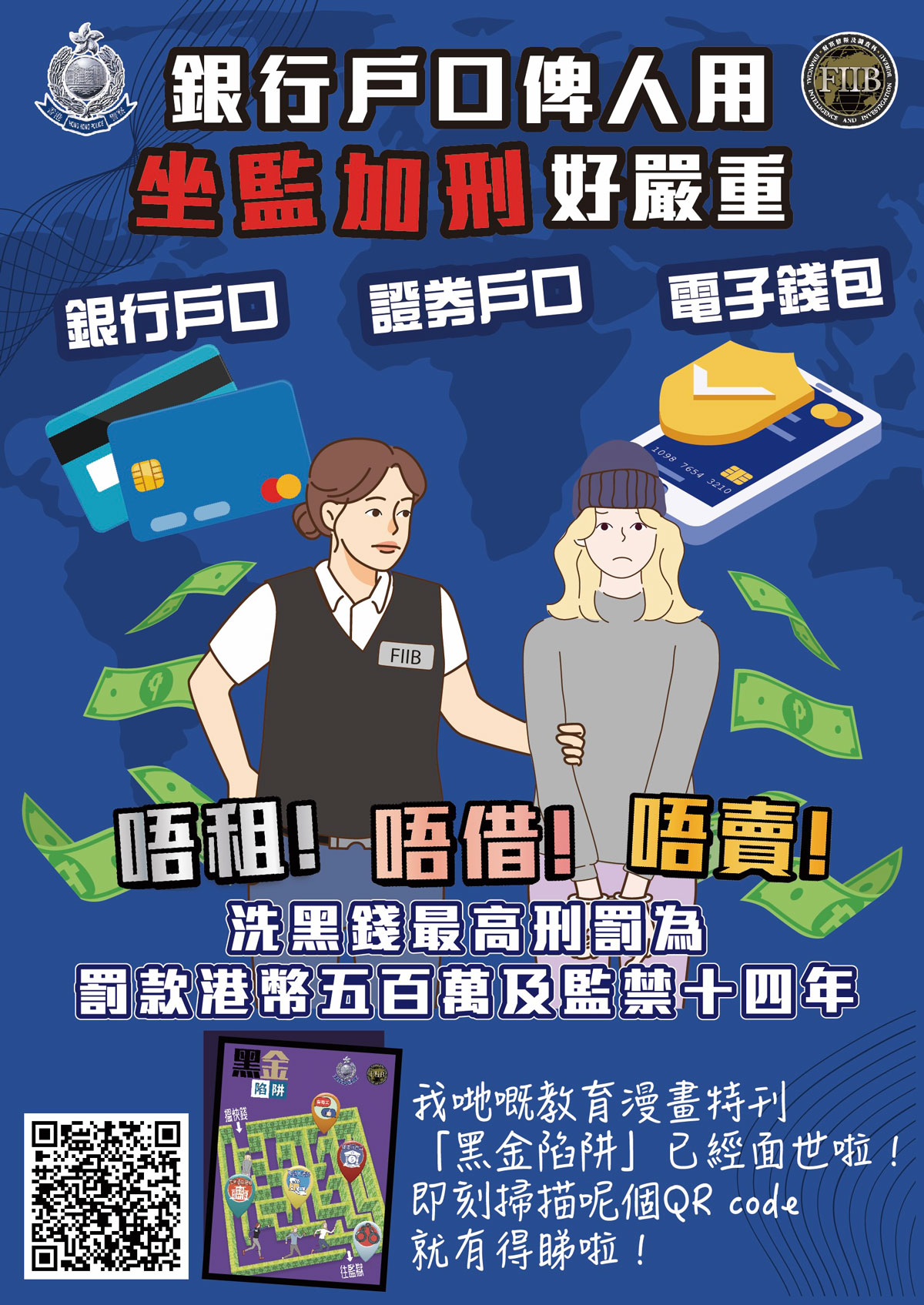

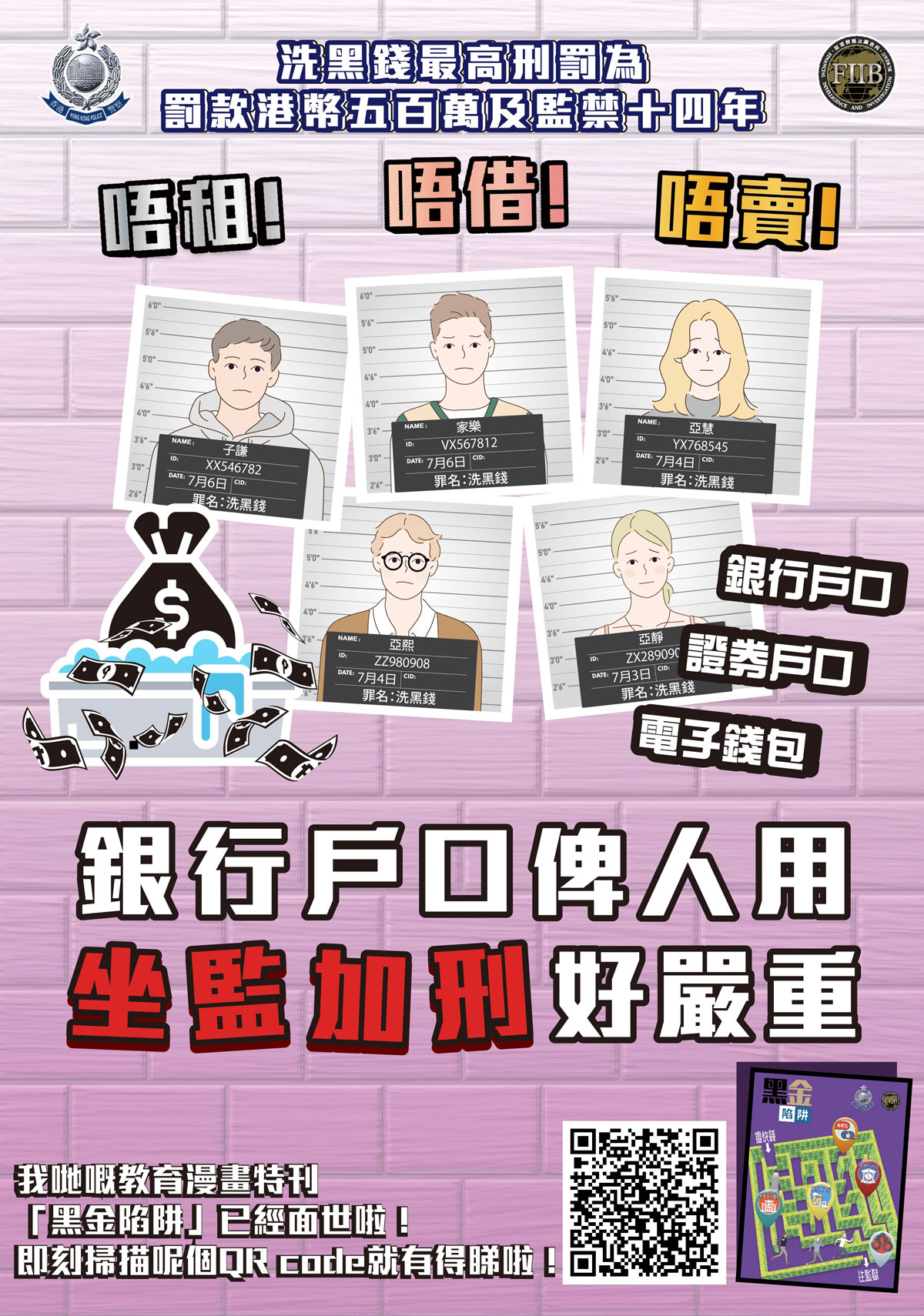

In 2023, the "AccFencers" set out again. To enhance public understanding of money laundering offences, three mascots namely "Don’t Rent", "Don’t Lend" and "Don’t Sell" designed by the Financial Intelligence and Investigation Bureau are there to remind the public not to rent, lend or sell their accounts to others as these may be abused for unlawful purposes.

2023 "AccFencers" Events

From 7 August to 25 August 2023, alongside with seminars and workshops, promotional videos and leaflets will be published and released on various platforms to disseminate the message of anti-money laundering and counter-financing of terrorism.

AML Albums

2023-08-25【AML Month - Operation WISEWORD Summary in August 2023】

Following “Target and investigate money laundering activities” in the Commissioner’s Operational Priorities 2023 and targeting the source of income of the triad associates, police mounted a large scale arrest operation named WISEWORD over the territories in the “Anti-Money Laundering Month” between 7 and 25 August 2023. As a result, 458 persons were arrested and 314 money laundering related cases, including online shopping, employment scam, telephone deception, romance scam and gambling related offences were detected, which involves suspected crime proceeds of over HKD 470 million. In the operation, police seized loads of bank documents, bank cards, mobile phones, computers, cash and valuables, and prevented the dissipation of over HKD 16 million of crime proceeds.

Click into the video to learn more about the operation.

2023-08-08【Operation JUSTICEGATE – 7 persons arrested for Conspiracy to Money Laundering】

Acting upon intelligence, the Financial Intelligence and Investigation Bureau identified a local money laundering syndicate recruiting stooges to open bank accounts for processing suspected crime proceeds of various money laundering related cases. Between October 2022 and June 2023, the syndicate used at least 48 local bank accounts to process suspected crime proceeds amounting to HKD 111 million by cash withdrawal and cryptocurrency trading. After in-depth investigation, an arrest operation codenamed JUSTICEGATE turned overt on 7 August 2023 with 7 persons arrested for “Conspiracy to Money Laundering”. In the operation, the police also raided a storage of the syndicate for storing bank cards and cash with seizure of HKD 0.32 million cash and a significant amount of bank cards, mobile phones, etc.

Click into the video to learn more about the case.

2023-07-26【Operation GREYTHUNDER – 6 persons arrested for Money Laundering】

Acting upon intelligence, the Financial Intelligence and Investigation Bureau carried out an operation codenamed "GREYTHUNDER" in multiple districts on 2023-07-25, arresting 6 local men aged between 24 and 36 for the offence of "Money Laundering". Investigation unveiled that the arrested persons belonged to a "Money Laundering" syndicate, which was suspected of using at least 33 local bank accounts to launder about HKD 175 million of suspected crime proceeds between May and November 2022. The investigation revealed that HKD 28 million of the crime proceeds was involved in at least 27 money laundering related cases, including “Pretend Officials” and “Investment Fraud”. The total loss from these fraud cases was about HKD 113 million. During the operation, multiple smartphones, computers, and bank documents were seized.

Click into the video to learn more about the case.

2023-06-22【Operation IRONSPLITTER – 7 members of cross-border money laundering syndicate arrested】

Police received intelligence from Mainland counterpart, reporting that a cross-border money laundering syndicate was suspected of using 320 Mainland bank accounts to receive HKD 460 million from 2,900 telephone deception cases in the Mainland between April and June 2023. The associated debit cards were then distributed to the syndicate members in Hong Kong, who purchased a large number of mobile phones, precious metal accessories etc. at Hong Kong shops, and then resold them for cash.

On 20 June, 2023, the Financial Intelligence and Investigation Bureau mounted an arrest operation codenamed "IRONSPLITTER", and arrested 5 persons for "Conspiracy to Defraud" and "Conspiracy to Money Laundering" in Tsim Sha Tsui and Sha Tin. Police also raided three industrial premises situated at To Kwa Wan and Yau Ma Tei, which are believed to be the operation centers of the syndicate, and arrested 2 persons therein for "Conspiracy to Defraud". During the operation, police seized HKD 1.37 million cash and a significant amount of banknote counting machines, computers, POS machines, new mobile phones, debit cards, etc.

Click into the video to learn more about the case.

2023-05-18【Operation CALMORDER – 17 persons arrested for Conspiracy to Money Laundering】

Acting upon intelligence, Financial Intelligence and Investigation Bureau unveiled an illegal syndicate providing online gambling service. The syndicate made use of local virtual bank accounts to receive bets and process the crime proceeds. Between June 2022 and April 2023, the syndicate employed at least 18 bank accounts for processing suspected crime proceeds amounting to HKD 240 million. After in-depth investigation, an arrest operation codename CALMORDER turned overt between 16 and 17 May 2023 and 17 locals were arrested for “Conspiracy to Money Laundering” with seizure of HKD 0.76 million cash and a significant amount of computers, mobile phones, bank cards, etc.

Click into the video to learn more about the case.

2023-04-26【Operation SWORDWIELDER – 14 persons arrested for Money Laundering】

Acting upon intelligence, the Financial Intelligence and Investigation Bureau unveiled an illegal syndicate made used of two Key Opinion Leader (“KOL”) management companies and 46 bank accounts to launder HKD 560 million crime proceeds, including HKD 60 million crime proceeds originated from 66 scam cases such as Telephone Deception, Investment Fraud, Romance Scan or other fraud occurred between November 2021 and July 2022. After in-depth investigation, an arrest operation codenamed SWORDWIELDER turned overt on 26 April 2023 and 14 persons were arrested for “Money Laundering” with seizure of a significant amount of computers, mobile phones, bank cards, bank documents, company documents etc.

Click into the video to learn more about the case.

2023-03-22【Anti-Money Laundering and Anti-Triad Operation – 43 persons arrested for Conspiracy to Money Laundering, Money Laundering and various offences】

Acting upon intelligence, the Financial Intelligence and Investigation Bureau and the Organized Crime and Triad Bureau unveiled a local triad syndicate that had been active in a series of violent incidents due to turf war and made use of 25 local bank accounts to process suspected crime proceeds amounting to HKD 210 million.

After in-depth investigation, police mounted an arrest operation codenamed BATTLEZONE and an anti-triad operation codenamed LEVINGTON on 20 March 2023 to raid a number of illegal establishment and residential premises over the territories, resulting in the arrest of 43 persons for “Conspiracy to Money Laundering”, “Money Laundering” and various offences, including “Operating Gambling Establishments”, “Keeping a Vice Establishment”, “Trafficking in Dangerous Drugs”, “Possession of Dangerous Drugs” and “Possession of Forged Document” with seizure of cash totaling HKD 0.51 million, gambling chips worth HKD 0.4 million, 18 gaming machines, 7 forged Hong Kong Identity cards, several luxury watches worth HKD 2.5 million and one luxury car.

Click into the video to learn more about the case.

2023-02-17【AML Month - Operation WISEWORD Summary in January and February 2023】

Following the Anti-Money Laundering Month, between January and February 2023, police mounted a large scale arrest operation named WISEWORD over the territories, during which 593 premises were searched and 633 persons were arrested for “Money Laundering” and related offences. The offenders, including stooge account holders and core syndicate members of criminal syndicates laundered suspected crime proceeds over HKD 7.8 billion., which involves 1,043 local and overseas crimes, including online shopping, employment scam, investment fraud, telephone deception, romance scam, dangerous drugs and gambling related offences. In the operation, police seized loads of bank documents, bank cards, mobile phones, computers and valuables, and prevented the dissipation of over HKD 116 million of crime proceeds.

Click into the video to learn more about the operation.

2023-01-19【Operation DARKALLEY – 5 persons arrested for Incitement to Money Laundering】

The Financial Intelligence and Investigation Bureau noted that posts for luring citizens into lending or selling their bank accounts (commonly known as stooge accounts) for money laundering were found on social media. Therefore, an operation codenamed “DARKALLEY” was mounted with cyber patrol conducted and decoy operatives disguised as sellers of bank accounts. After in-depth investigation, the arrest operation turned overt between 18 and 19 January 2023 with 5 persons for “Incitement to Money Laundering” with seizure of a significant amount of mobile phones, pre-paid sim cards, a small quantity of dangerous drugs and dangerous drug-inhaling apparatus, etc.

Click into the video to learn more about the case.

2023-01-10【Operation JUSTICENET – 18 persons arrested for Conspiracy to Money Laundering and Money Laundering】

Acting upon intelligence, the Financial Intelligence and Investigation Bureau unveiled a local syndicate recruiting domestic helper as stooges to open bank accounts for processing suspected crime proceeds. Since May 2021, the syndicate used at least 33 local bank accounts to process suspected crime proceeds amounting to HKD 33 million, including fraudulent payments to romance scam, investment fraud, and e-mail scam.

After in-depth investigation, an arrest operation codenamed JUSTICENET turned overt on 9 January 2023 and raided residential premises over the territories, resulting in arrests of 18 persons for “Conspiracy to Money Laundering” and “Money Laundering” with seizure of a significant amount of mobile phones, SIM cards and bank cards.

Click into the video to learn more about the case.

2022-12-15【Operation FLYINGSWORD– 22 persons arrested for Conspiracy to Bookmaking and Money Laundering】

Acting upon intelligence, the Financial Intelligence and Investigation Bureau and the Cyber Security and Technology Crime Bureau unveiled a local syndicate running a gambling mobile application and recruiting stooges to open bank accounts for receiving bets and processing suspected crime proceeds. Since July 2019, the syndicate used at least 51 local traditional and virtual bank accounts to received bets amounting to HKD 7.75 million and process suspected crime proceeds amounting to HKD 186 million, including fraudulent payments from online investment fraud, pretend official telephone deception and e-shopping fraud. After in-depth investigation, the Financial Intelligence and Investigation Bureau and the Cyber Security and Technology Crime Bureau mounted an arrest operation codenamed FLYINGSWORD between 2022-12-14 and 2022-12-15 to raid an operation centre in a commercial building unit and residential premises over the territories, resulting in arrests of 22 persons for “Conspiracy to Bookmaking”, “Conspiracy to Money Laundering” and “Money Laundering” with seizure of cash totaling HKD 6.6 million, 12 computers, 50 mobile phones and two luxurious cars.

Click into the video to learn more about the case.

2022-12-06【Operation FARREACH– 13 persons arrested for Conspiracy to Money Laundering and Obtaining Property by Deception】

Acting upon intelligence, the Financial Intelligence and Investigation Bureau unveiled a local syndicate recruiting stooges to open bank accounts for processing suspected crime proceeds. Since March 2022, the syndicate used at least 104 local virtual bank accounts to process suspected crime proceeds amounting to HKD 186 million, including fraudulent payments to boosting sales scam, investment fraud, e-shopping fraud and romance scam. After in-depth investigation, an arrest operation codenamed FARREACH turned overt on 2022-12-05 and raided an operation centre in an industrial building unit and residential premises over the territories, resulting in arrests of 13 persons for “Conspiracy to Money Laundering” and “Obtaining Property by Deception” with seizure of a significant amount of mobile phones, SIM cards and bank cards.

Click into the video to learn more about the case.

2022-10-20【Operation MINEPELLET – 7 persons arrested for Conspiracy to Money Laundering】

Acting upon intelligence, the Financial Intelligence and Investigation Bureau unveiled an illegal syndicate providing online gambling service and recruiting gamblers on social media. The syndicate also recruited stooges to open bank accounts for processing suspected crime proceeds. Since April 2022, the syndicate used at least 25 local virtual bank accounts to process suspected crime proceeds amounting to HKD 40 million. After in-depth investigation, an arrest operation codenamed MINEPELLET turned overt on 19 October 2022 and 7 persons were arrested for “Conspiracy to Money Laundering” with seizure of a significant amount of mobile phones, computers, bank cards, etc.

Click into the video to learn more about the case.

2022-09-26【Court Judgement • Confiscation of HKD 70M Crime Proceeds】

Since June 2019, a fund-raising platform was found asking for public donation via social media platform, proclaiming the received funds would be used to provide legal financial support to those arrested during Operation TIDERIDER. Financial analysis transpired that the public donation, amounting to HKD 80 million, was deposited into a company account of a private company.

In-depth financial investigation revealed that, out of the HKD 80 million public donation, only a small portion of around HKD 450,000 were paid to those Operation TIDERIDER arrestees or related persons, while the remaining funds were either withdrawn by cash or channeled to other personal accounts of the abovementioned company account holder and his three accomplices.

Having secured the prima facie of money laundering case in relation to the crowd funding activities on Spark Alliance platform, the four identified operators were arrested in December 2019 with around HKD 70 million crime proceeds frozen. Later in Oct 2020 and Mar 2021, two arrested persons were found leaving Hong Kong respectively while on bail and had never returned. Subsequently, according to section 8, Cap 455 of Hong Kong Law, police applied to the High Court for confiscating the related assets. In September 2022, confiscation order to forfeit the crime proceeds of HKD 70 million was granted at the High Court.

Click into the video to learn more about the case.

AML Classroom

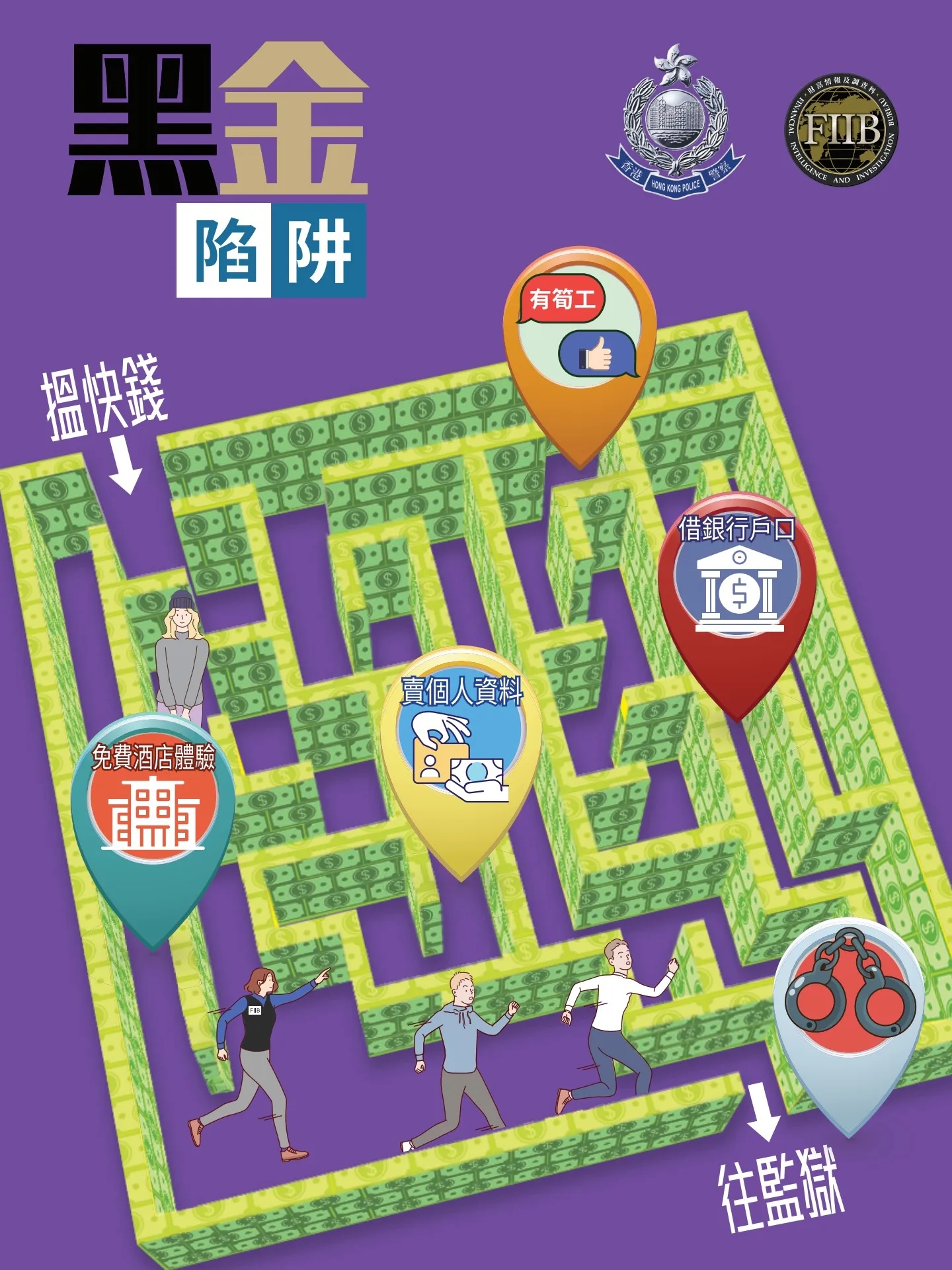

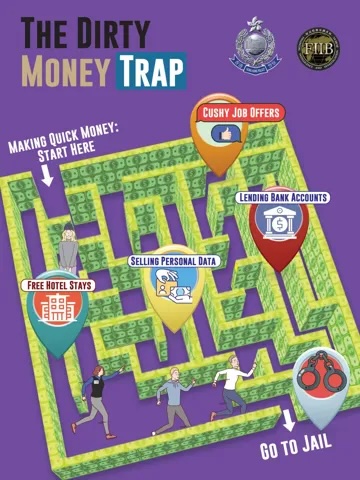

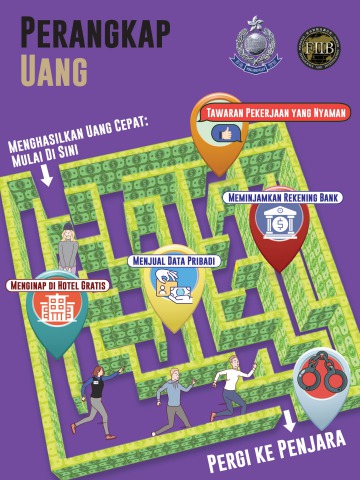

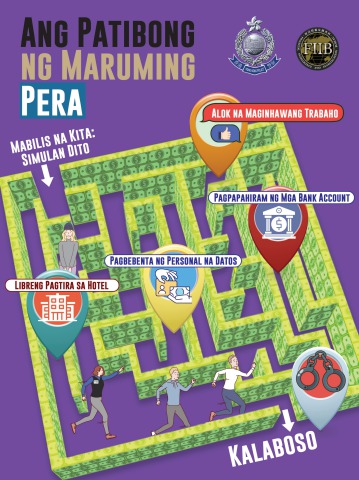

AML e-Comic Book 'The Dirty Money Trap'

AML Publications

Common Modus Operandi

Virtual Trading Scam

Crime syndicates lure citizens into opening accounts in various banks and provide the accounts for receiving fund transfers from unknown individuals. Account holders were instructed to use the funds to purchase cryptocurrency and transfer it to a designated wallet. In fact, the funds are proceeds of crime and the bank accounts were being used for money laundering purpose.

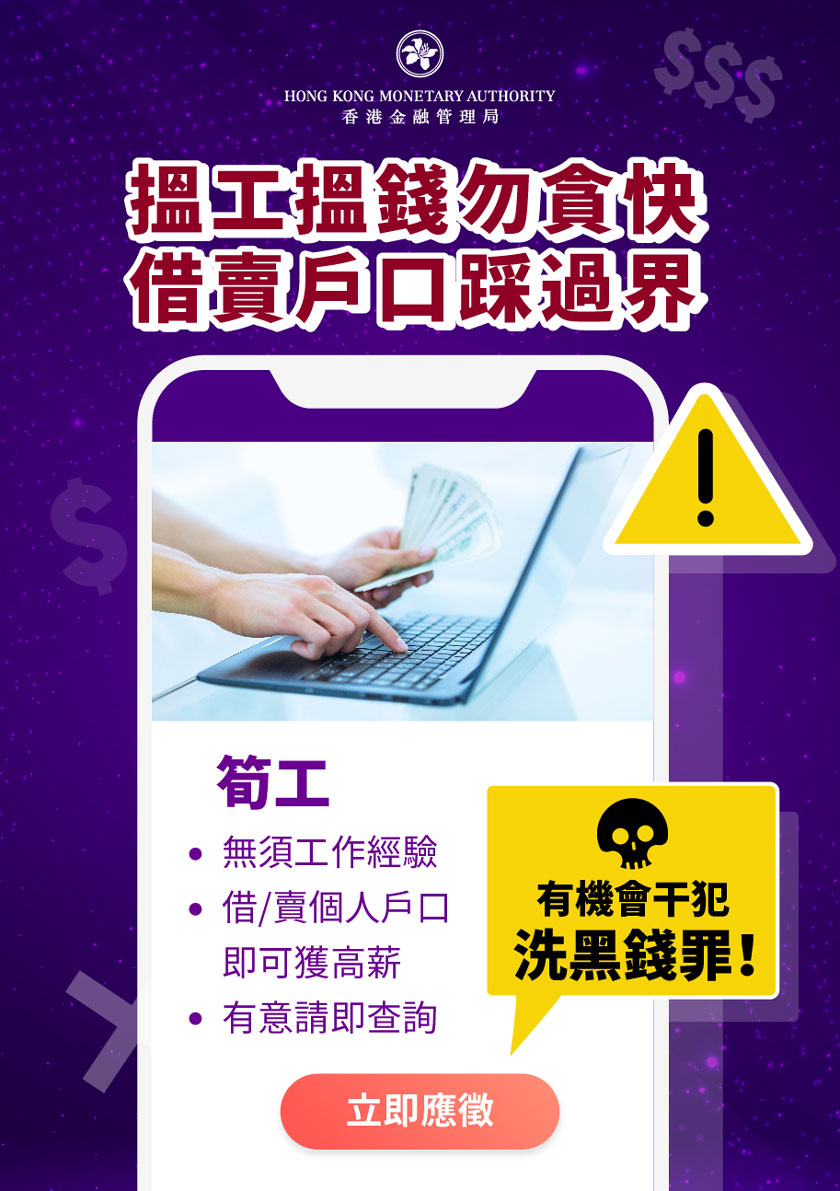

Employment Trap

Fraudsters make use of social media platforms to post “quick cash jobs” recruitment advertisements. Job seekers are indeed lured to provide their bank accounts, which will be used by fraudsters as stooge accounts for laundering proceeds of crime. Previous cases suggested that fraudsters claimed that accommodation and beverage would be provided in job recruitment posts. Instead, job seekers would be detained in hotel rooms for days, during which their bank accounts were being used for money laundering purpose. Job seekers should beware of common employment traps and always be cautious.

Money Mule Scam

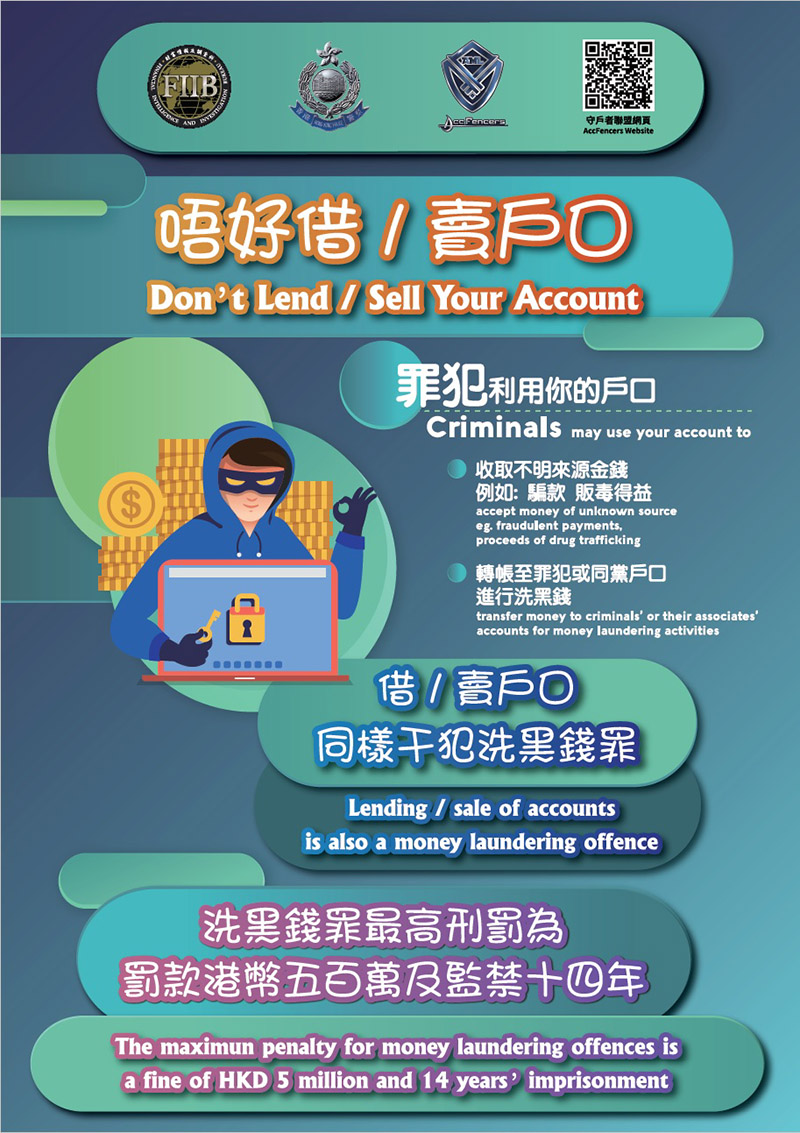

Crime syndicates make use of social media platforms to lure citizens into lending or selling their bank accounts, claiming it is “safe and legal”, but are in fact using the bank accounts as stooge accounts for money laundering. The personal data of the account holder may also be used by lawbreakers for illegal purposes.

Online Romance Scam

Swindlers approach victims on social media platforms and develop an intimate relationship with them to earn their trust. Swindlers will then ask victims to help set up a bank account, claiming it is for investment purpose, but are in fact using the account for money laundering.

Anti-Money Laundering Micro Film

The Hong Kong Association of Banks' Anti-Fraud Guide Episodes

Relevant Legislation on Money Laundering

Under section 25(1) of the Drug Trafficking (Recovery of Proceeds) Ordinance, Cap 405 and section 25(1) of the Organized and Serious Crimes Ordinance, Cap 455, Money laundering is an offence for a person who, knowing or having reasonable grounds to believe that any property which, in whole or in part, directly or indirectly represents any person’s proceeds of drug trafficking or indictable offence, deals with that property.

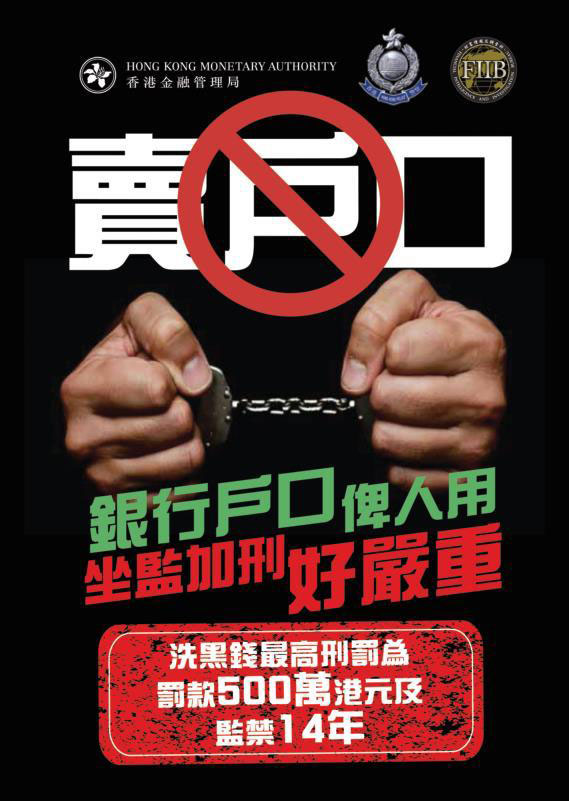

Maximum penalty is a HK$ 5,000,000 fine and 14-year imprisonment.

Terrorist Financing

Under the following provisions of UNATMO Cap.575, it is an offence if a person:

- provides or collects property, with intention or knowing or having reasonable grounds to believe, that the property, in whole or in part be used or will be used to commit one or more terrorist acts (section 7)

- makes property or financial services available to or for the benefit of terrorist or terrorist associate. (section 8)

Maximum penalty is a fine and 14-year imprisonment.

UNATMO Cap. 575 has been fully implemented since 1st January 2011. Under section 6 of Cap. 575 the Secretary for Security is authorized to freeze the property of terrorists or of persons connected with terroristsection It is an offence under section 14 if a person knowingly contravenes a notice under section 6(1) or contravenes a requirement under section 6(7).

To read more about these sections of the legislation, please follow this link to the explanatory notes of section 6 and section 14 of Cap. 575 or this link to the Hong Kong E-Legislation.

AML Infopack

Joint Financial Intelligence Unit Publications

For JFIU publications, please follow this link to the JFIU webpage.

Statistics

For statistics of the conviction, assets recovery and suspicious transaction report, please follow this link to the JFIU webpage.

Suspicious Transaction Report

For details of the suspicious transaction report, please follow this link to the JFIU webpage.